can you ever owe money on stocks

While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio. The broker funds you with 50 of your account value.

Your State Could Owe You Hundreds Of Dollars How To Find Out In 2022 How To Find Out Dollar Missing Money

Do you ever owe money on stocks.

. If you invest in stocks with a cash account you will not owe money if a stock goes down in value. In short yes you can lose more than you invest. Read on to learn the circumstances.

Even if you borrow to buy shares or funds or whatever youll get a margin call and automatic closeout liquidation of your position before you go negative. It really depends on whether youre buying stocks on a margin loan or with cash. If you dont use any margin at all youll never owe money on a stock.

This can happen when a stock is declining in value as well as when it is appreciating in value. While stock prices fluctuate to reflect changing market assessments of the value of a company a stocks price can never go below zero so an investor cannot actually owe money due to a decline in stock price. You cannot have negative money in stocks because even if the price of your stocks fluctuates or falls drastically it cannot attain a value less than zero.

There are specific instances where a person can be in debt from stock purchases. At least you SHOULD with any decent broker. Former stockbroker market maker investment coexec Author of Stock Market Trivia Author has 83 answers and 618K answer views.

When a person buys a security on margin a broker is lending money to purchase securities beyond what the individual has available in his or her account. Losing money in the stock market happens quite often. Yes if you use leverage by borrowing money from your broker with a margin account then you can end up.

While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio. It all depends on whether youre purchasing stocks with cash or on a margin loan. If the stocks price dropped to 0 you would owe the lender nothing and your profit would be 5000 or 100.

However while this cannot happen the book value can go negative and you can lose more money than you invested or end up in debt. You wont generally owe money to your brokerage if your stocks bonds ETFs mutual funds or other assets lose value. But that depends on the type of account you have and how you are investing your money.

A shady one might not liquidate or might liquidate early or never put on your trade in the first place. While one cannot owe money due to a stock price dipping below zero it is possible for aggressive investors to owe money on a stock market portfolio. Access Our Full Suite of Innovative Award-Winning Trading Platforms Built for Traders.

If you do it will be treated as an excess contribution to the IRA and youll owe a 6 annual penalty each year that the money remains in the account. Selling Stocks on a Margin. The investor can pay 50 of the stock shares and fund the remaining 50 using debt.

You may also owe money on stocks if you trade see on a margin account. How To Invest Your Money When Inflation Is High Of Dollars And Data Investing Wealth Management Owe Money. However if you buy stocks using borrowed money you will need to repay your debt regardless.

The price of the stock has to drop more than the percentage of margin you used to fund the purchase in order for you to owe money. The value of your investment will decrease but you will not owe money. If you wish to navigate this tempestuous period in the stock markets the views of this 91-year-old at the top of his game for more than half a century are more relevant than ever.

If you buy stock using borrowed money you will owe money no matter which way the stock price goes because you have to repay the loan. If your stocks bonds mutual funds ETFs or other securities lose value you wont normally owe money to your brokerage. The investor uses the credit line to buy stocks.

However you could not get all of your money back when you sell. These accounts allow investors to buy stock shares worth more than what they have. Margin borrowing available at most brokerages allows investors to borrow money to buy stock.

Do I owe money if a stock goes down. So can you owe money on stocks. Technically yes but practically no.

Discover the Power of thinkorswim Today. Even though the value of a stock can never go below zero it is possible to lose more than what you invested in the stock market and end up with a debt. If a company goes bankrupt its stock can conceivably be worthless but no worse than that.

However you may not receive all of your money back ifwhen you sell. Major indexes like the New York Stock Exchange will actually de-list stocks that. If however the stock price went.

If you invest in stocks with a cash account you will not owe your broker money even if the stocks go to zero. No asset property security or currency can ever be worth less than zero. Situations Where You Can Lose More Than You Invested.

If a stock drops in price you wont necessarily owe money. Yes you can owe money on stocks if you buy stocks through a margin account because a margin account allows an investor to buy stocks on credit. In a margin account a brokerage or investment bank extends a line of credit or margin to an investor.

Secrets To Lowering Your Taxes In Retirement Bottom Line Inc

Can You Owe Money To Robinhood Full Details

The Common Theme Here Is Not Owe Money But To Make Money

Can You Owe Money On Stocks You Ve Invested In

What Happens If I Buy A Stock And It Goes Down

Can You Owe Money To Robinhood Full Details

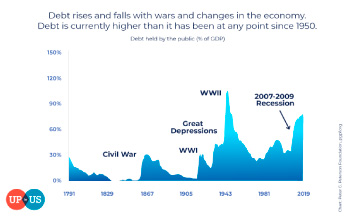

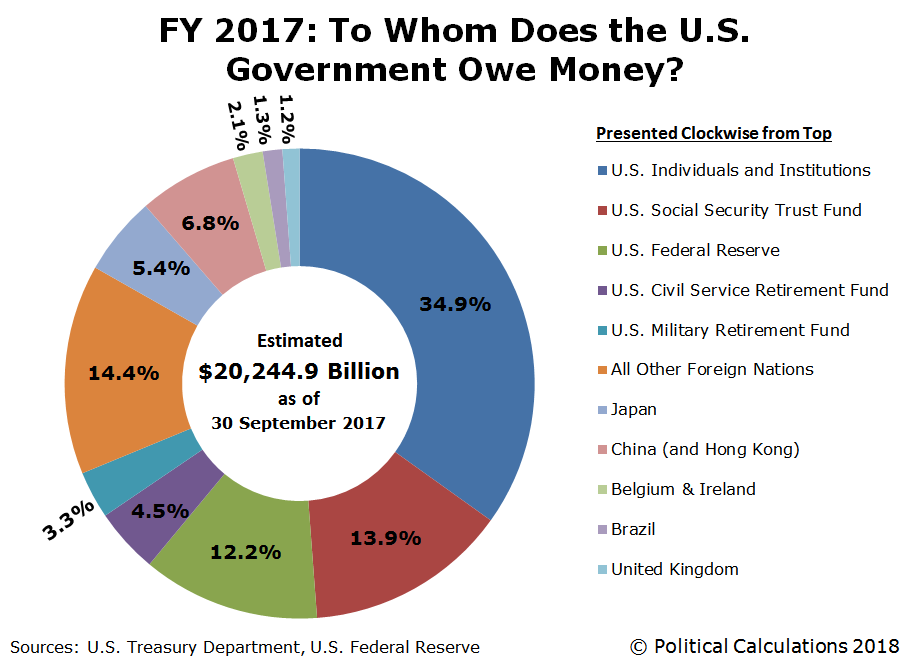

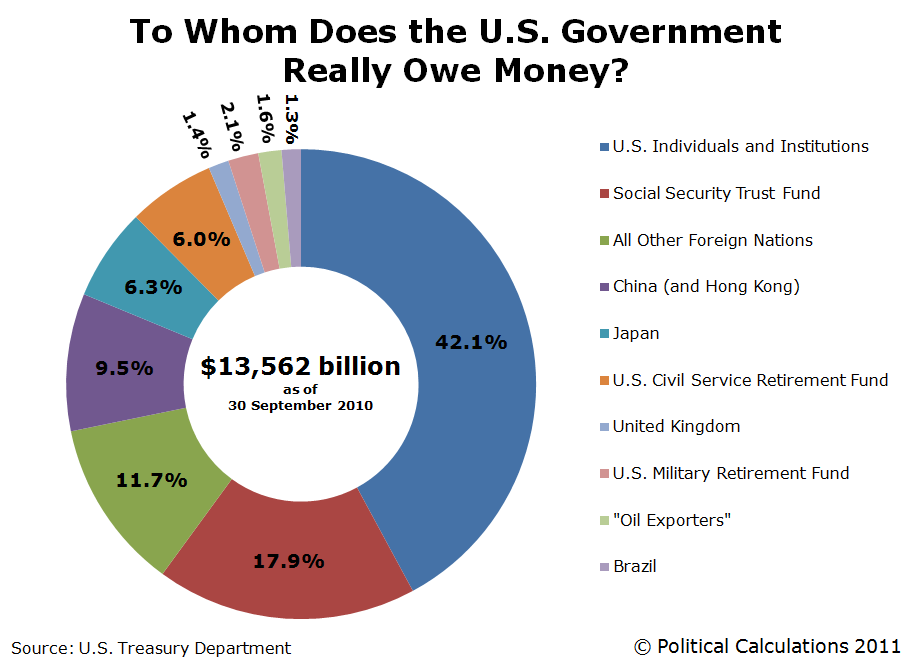

Who Does The Us Owe Money To 2020 Update I Up To Us

Can You Owe Money To Robinhood Full Details

Can You Owe Money On Stocks You Ve Invested In

35 Clever Products That Will Save You Money Down The Road Save Your Money Help Save Money Saving Money

Can Stocks Go Negative Will You Owe Money

To Whom Does The U S Government Owe Money Seeking Alpha

Who Holds The U S National Debt Seeking Alpha