Fed rate hike

Some even expect the Fed to. What rising interest rates mean for you.

Stocks Fell Right After Fed Raised Interest Rates Will This Continue

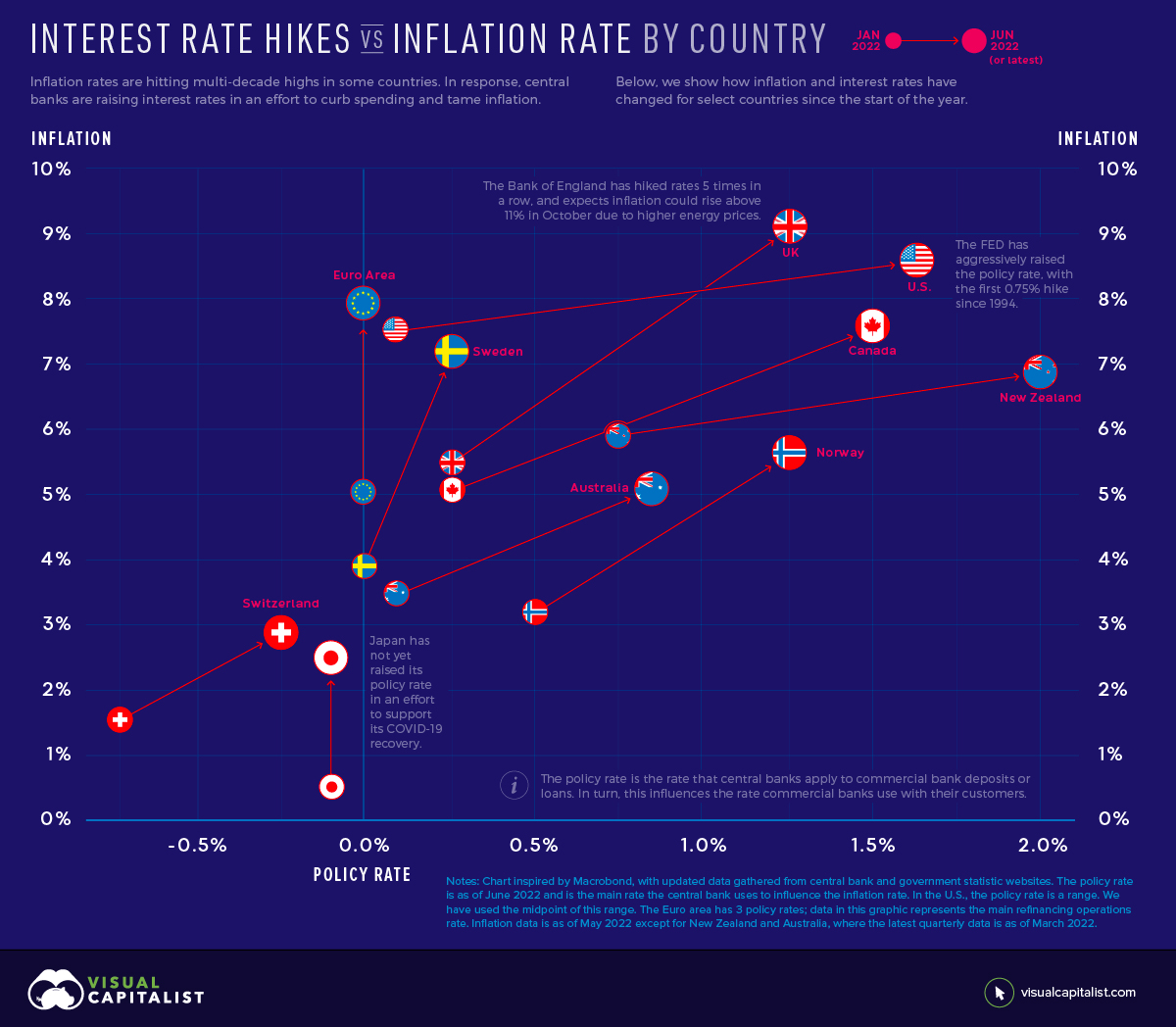

The Federal Reserve delivered its latest monetary policy announcement with the central bank hiking rates by 75 basis points or 075 percentage point.

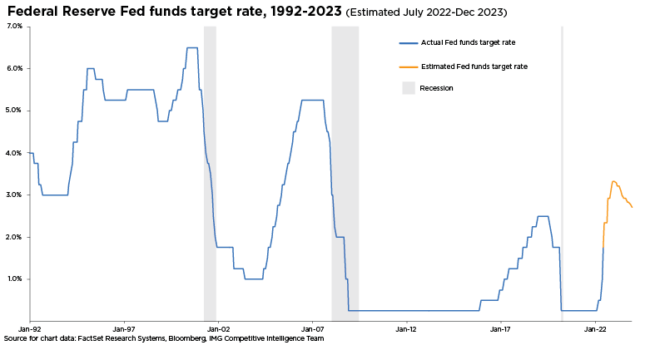

. The rate hike the Fed is expected to deliver on Wednesday will move the target federal funds rate 75 basis points higher to a level between 375 and 400. The Feds target policy rate is now at its highest level since 2008 - and new projections show it rising to the 425-450 range by the end of this year and ending 2023 at. The Wall Street Journals full.

It wont budge until. Overall the new projections show. The Federal Reserve will raise interest rates as high as 46 in 2023 before the central bank stops its fight against soaring inflation according to its median forecast released.

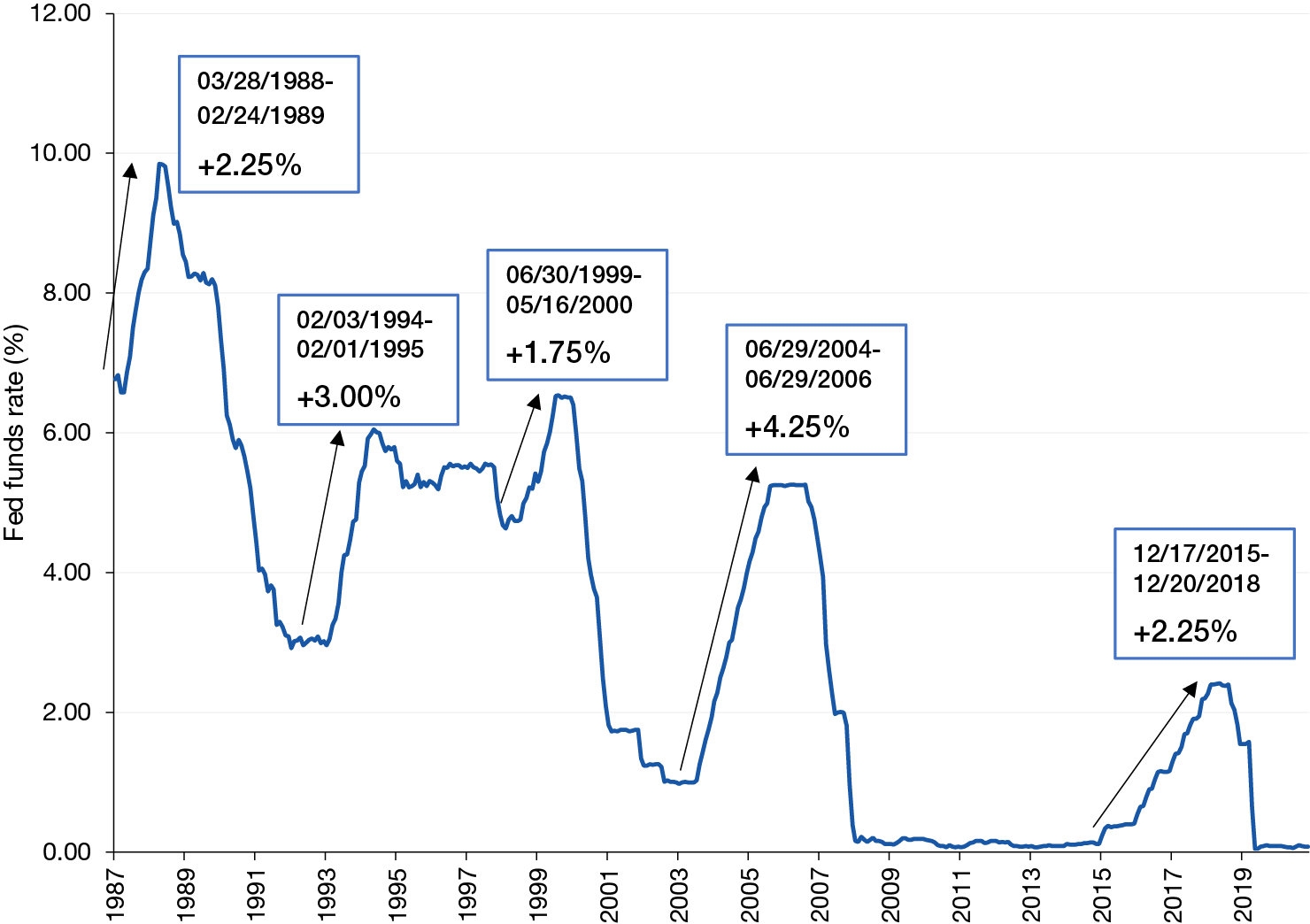

That point of view runs counter to market consensus which currently expects a 75 basis point rate hike in November followed by a 50 basis point rate hike in December. The new language in the policy statement took note of the still-evolving impact that the Feds rapid pace of rate hikes has set in motion and a desire to hone in on a level for the. Pricing of futures tied to the Feds policy rate implied a 92 chance that the Fed will raise its policy rate now at 3-325 to a 375-4 range when it meets Nov.

Powell announced another interest rate hike on Wednesday. Nov 2 2022 at 318 pm ET. Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

The Federal Reserve will raise interest rates just one more time in November before it stops due to a soaring US dollar according to market veteran Ed Yardeni. Officials approved a third straight 75 basis point rate hike in September lifting the federal funds rate to a range of 30 to 325 near restrictive levels and showed no signs of slowing. Adjustable-rate loans such as ARMs that are no.

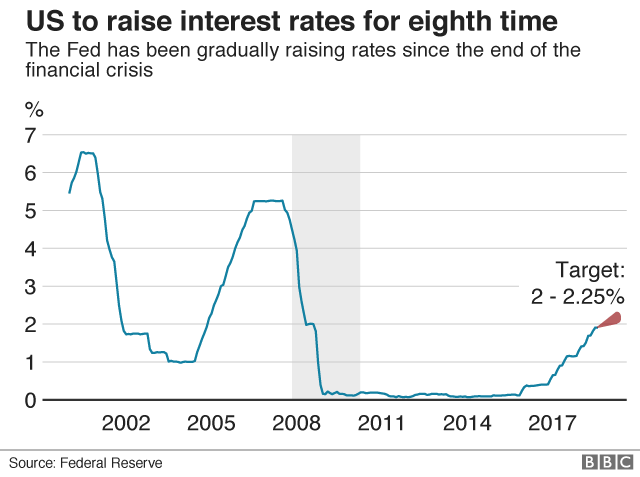

The latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008. Stocks Fall After Fed Hikes Interest Rates 075 Percentage Point. Fed Meeting Today Live.

The rate was also revised higher for 2024 to 39 from 34 in June and is expected to remain elevated at 29 in 2025. Follow along with our. Prices rose by a hotter-than-expected 83 in August while core inflation a measure that excludes volatile food and energy prices jumped by 63.

That implies a quarter-point rate rise next year but. A Fed Hike means that the voting members of the FOMC voted to increase its target for the key policy rate of the United States the US Target Federal Funds Rate known as the. The Feds latest increase brings the federal funds rate which acts as a benchmark for everything including business loans credit card and mortgage rates to between 375.

During his post-meeting conference Fed Chair Jerome Powell signaled. That means the 075 percentage-point hike on Wednesday will add an extra 75 of interest for every 10000 in debt. For borrowers and consumers the fed rate hike means that many types of financing will cost more due to higher interest rates.

The Federal Reserve raised interest rates 75 basis points on Wednesday bringing its federal funds rate target to a range of 375 to 4. The Federal Reserve on Wednesday enacted its second consecutive 075 percentage point interest rate increase as it seeks to tamp down runaway inflation without. The Federal Reserve ordered another big boost in interest rates on Wednesday and warned that rates will have to.

So far the Feds five hikes in 2022 have increased rates by a. The interest rate on federal student loans taken out for the 2022-2023 academic year already rose to 499 up from 373 last year and 275 in 2020-2021.

Will Steep Interest Rate Hikes Cause A Recession Nationwide Financial

How The Stock Market Has Performed During Fed Rate Hike Cycles

Which Assets Have Done Well During Fed Rate Hikes

How The Stock Market Has Performed During Fed Rate Hike Cycles

Federal Reserve Raises Interest Rates Again Bbc News

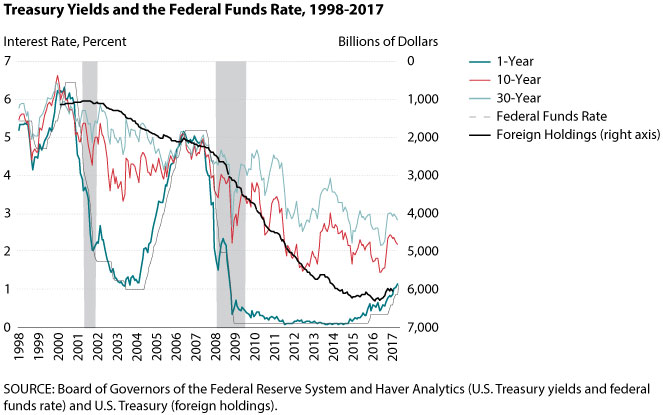

The Rising Federal Funds Rate In The Current Low Long Term Interest Rate Environment St Louis Fed

Raising Interest Rates In Uncharted Territory

Fed Cuts Us Interest Rates To Zero As Part Of Sweeping Crisis Measures Financial Times

Fed Parties Like It S 2018 With First Interest Rate Hike In Four Years

About Those Fed Rate Hikes They Might Take Longer Than You Think Chief Investment Officer

Fed Hikes Rates By 0 75 Percentage Point Biggest Increase Since 1994

Why One Expert Predicts More Rate Hikes Before Inflation Slows And How To Prepare Nextadvisor With Time

Tight Rope History S Lessons About Rate Hike Cycles Charles Schwab

The Fed Raises Interest Rates By 0 75 Percentage Points To Tackle Inflation The New York Times

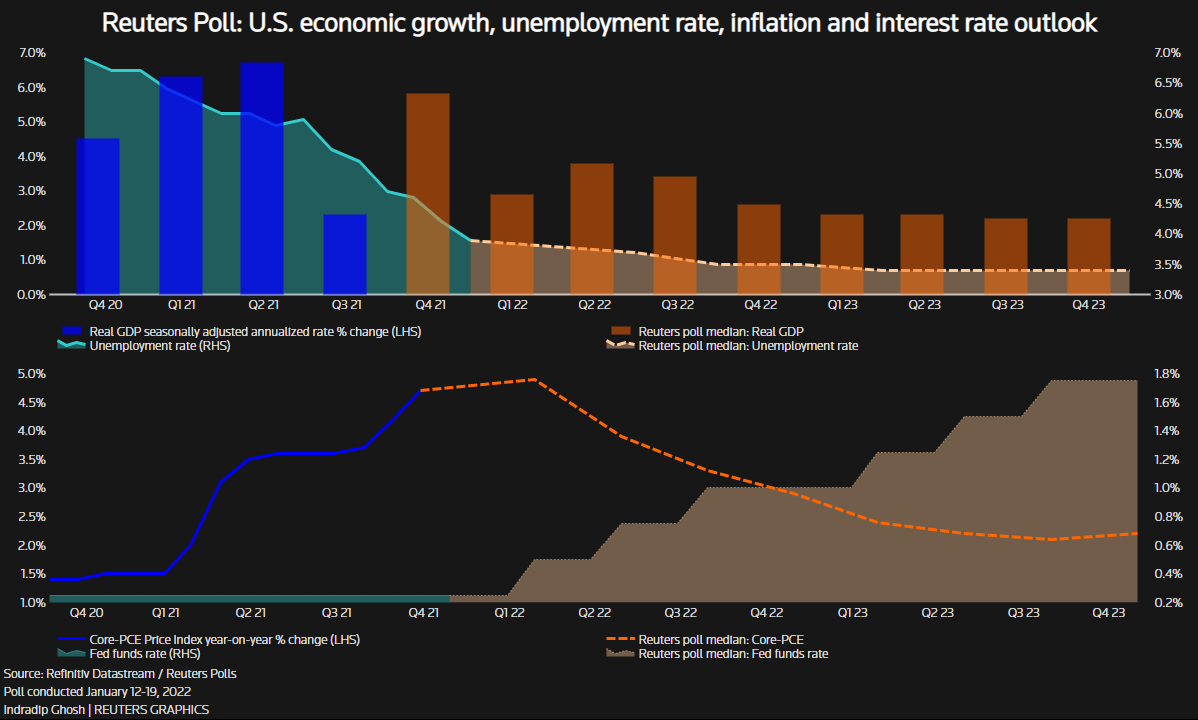

Fed To Raise Rates Three Times This Year To Tame Unruly Inflation Reuters Poll Reuters

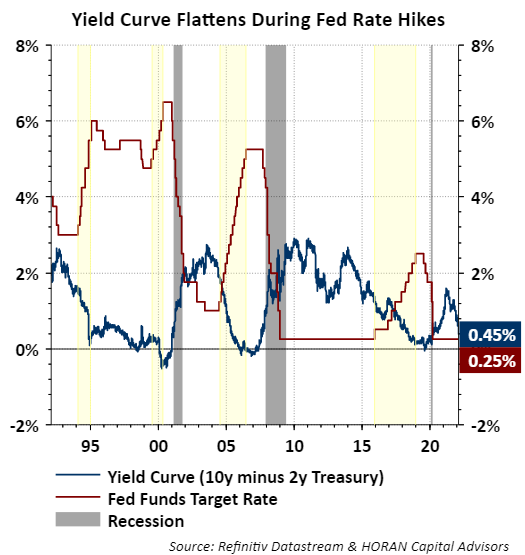

Fed Rate Hikes And Recessions Horan

Ecb Interest Rate Hike What Does It Mean For The Markets World Economic Forum